U.S. petroleum product exports reach record high in 2014 (3/4/2015)

Release date: March 4, 2015 | Next release date: March 11, 2015

EIA’s December Petroleum Supply Monthly data show that exports of noncrude petroleum products from the United States averaged 3.8 million barrels per day (bbl/d) in 2014, an increase of 347,000 bbl/d from 2013, and a new record high. Increased exports of motor gasoline and hydrocarbon gas liquids (HGL), including propane and butane, were the main contributors to the trend, while exports of distillate decreased.

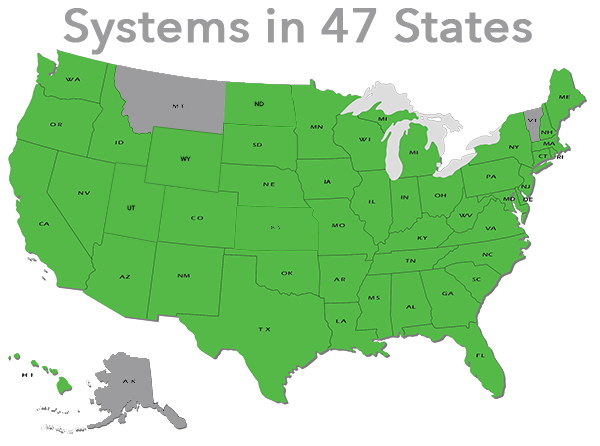

Record-high U.S. refinery runs, which averaged 16.1 million bbl/d in 2014, and increased global demand for petroleum products allowed U.S. petroleum product exports to increase for the 13th consecutive year. U.S. exports are mostly sent to nearby markets in Central America and South America, which grew year-over-year by 172,000 bbl/d (15%), followed by exports to Canada and Mexico, which rose 80,000 bbl/d (8%). The only decline in exports was to the Middle East, which went from 55,000 bbl/d in 2013 to 47,000 bbl/d in 2014. However, in 2014, there was more change on a product-by-product basis, both in quantity exported and destination—in particular exports of motor gasoline, HGLs, and distillate (Figure 1).

December 2014 exports of motor gasoline, which include finished gasoline and gasoline blending components, set a record high at 875,000 bbl/d. For the past several years, monthly exports of gasoline have been highest in November and December (Figure 2). As noted in a recent EIA analysis, low seasonal U.S. gasoline demand in December creates a larger surplus of gasoline, particularly on the U.S. Gulf Coast (PADD 3), resulting in increased exports to destinations farther afield such as Africa and Asia. As evidence of this trend, exports of motor gasoline to Africa and Asia rose 2,200 bbl/d (6%) and 1,200 bbl/d (20%), respectively, in 2014. The largest increase was in exports of motor gasoline to Central America and South America, which increased 42,000 bbl/d (27%). The leading recipients were Ecuador, Colombia, and Panama.

Increased U.S. production and capacity to export HGLs, particularly on the U.S. Gulf Coast, allowed exports of propane and butane to increase by 121,000 bbl/d (40%) and 44,000 bbl/d (149%), respectively, over 2013. Exports of propane to Asia, particularly Japan and China, where the fuel is used in cooking, heating, transportation, and as a petrochemical feedstock, nearly doubled in 2014 from 2013, increasing 40,000 bbl/d (95%). Propane exports to Central America and South America, historically the principal destination for U.S. propane, increased 31,000 bbl/d (21%) from 2013. Exports of butane, which shares some uses with propane but is more suitable for use in warmer climates, grew to 74,000 bbl/d. In 2014, the United States exported 20,000 bbl/d of butane to Africa, an increase of 17,200 bbl/d (628%) from a year earlier (Figure 1).

Increases in motor gasoline and HGL exports offset a decline in distillate exports, which decreased 19,500 bbl/d, the first year-over-year decline in distillate exports since 2003. While exports of distillate increased year-over-year to traditional U.S. export destinations like Central America and South America, whose imports from the United States rose 39,000 bbl/d (7%), and North America, which grew 3,000 bbl/d (2%), they were offset by declines in exports to Western Europe and Africa, which decreased by 62,000 bbl/d (15%) and 8,700 bbl/d (35%), respectively, in 2014. In the second half of the year increased European refinery runs, exports from recently upgraded Russian refineries, and new refinery capacity in the Middle East increased supply to European distillate markets, reducing the need for distillate from the United States (Figure 3).

U.S. average gasoline price up 14 cents, diesel prices increase

The U.S. average retail price for regular gasoline rose 14 cents over last week, to $2.47 per gallon as of March 3, 2015, down $1.01 per gallon from a year ago. The large one-week increase in the U.S. average is the result of higher crude oil prices passed through to retail gasoline, exacerbated by a larger West Coast price increase as a result of regional refinery disruptions. The West Coast price increased 37 cents to $3.13 per gallon. The Gulf Coast price was up 11 cents to $2.22 per gallon, followed by the Midwest price, which rose 10 cents to $2.38 per gallon. The East Coast and Rocky Mountain price each increased eight cents to $2.39 per gallon, and $2.12 per gallon, respectively.

The U.S. average price for diesel fuel increased four cents from the week prior to $2.94 per gallon, down $1.08 per gallon from the same time last year. The East Coast price increased eight cents, to $3.08 per gallon. The West Coast price rose three cents to $3.08 per gallon, and the Rocky Mountain price increased two cents to $2.78 per gallon. The Midwest price rose two cents to $2.85 per gallon, while the Gulf Coast price was up less than a penny to $2.80 per gallon.

Propane inventories fall

U.S. propane stocks decreased by 4.2 million barrels last week to 55.1 million barrels as of February 27, 2015, 27.9 million barrels (102.8%) higher than a year ago. Midwest inventories decreased by 2.5 million barrels and East Coast inventories decreased by 0.9 million barrels. Gulf Coast inventories decreased by 0.6 million barrels and Rocky Mountain/West Coast inventories decreased by 0.2 million barrels. Propylene non-fuel-use inventories represented 8.1% of total propane inventories.

Residential heating fuel prices Increase

As of March 2, 2015, residential heating oil prices averaged nearly $3.29 per gallon, 10 cents per gallon higher than last week, and almost 94 cents per gallon less than last year's price for the same week. Wholesale heating oil prices averaged $2.37 per gallon, nearly 7 cents per gallon higher than last week and almost 99 cents per gallon lower when compared to the same time last year.

Residential propane prices averaged just below $2.36 per gallon, about 1 cent per gallon higher than last week, and 94 cents per gallon less than the price at the same time last year. The average wholesale propane price increased by 3 cents per gallon this week to 78 cents per gallon, nearly 73 cents per gallon lower than the March 3, 2014 price.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at 202-586-0786.

Retail prices (dollars per gallon)

| Retail prices | Change from last | ||

|---|---|---|---|

| 03/02/15 | Week | Year | |

| Gasoline | 2.473 | 0.141 | -1.006 |

| Diesel | 2.936 | 0.036 | -1.080 |

| Heating Oil | 3.289 | 0.103 | -0.937 |

| Propane | 2.358 | 0.005 | -0.943 |

Futures prices (dollars per gallon*)

| Futures prices | Change from last | ||

|---|---|---|---|

| 02/27/15 | Week | Year | |

| Crude oil | 49.76 | -0.58 | -52.83 |

| Gasoline | 1.768 | 0.127 | -1.022 |

| Heating oil | 2.299 | 0.187 | -0.790 |

| *Note: Crude oil price in dollars per barrel. | |||

Stocks (million barrels)

| Stocks | Change from last | ||

|---|---|---|---|

| 02/27/15 | Week | Year | |

| Crude oil | 444.4 | 10.3 | 80.6 |

| Gasoline | 240.1 | 0.0 | 11.1 |

| Distillate | 123.0 | -1.7 | 8.5 |

| Propane | 55.070 | -4.168 | 27.915 |