U.S. crude oil inventories increase as WTI contango deepens (3/11/2015)

Release date: March 11, 2015 | Next release date: March 18, 2015

In recent weeks, the price of West Texas Intermediate (WTI) crude oil for near-term delivery declined relative to the price for longer-dated deliveries, deepening the contango in the Nymex WTI futures market. At the same time, the contango in the ICE Brent futures market lessened as the price of near-term Brent crude oil prices rose (Figure 1).

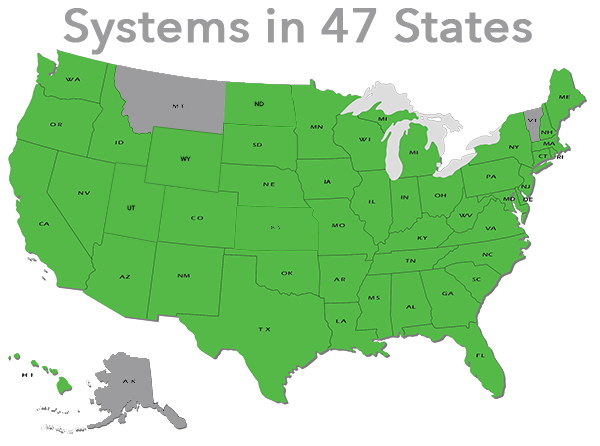

In January, global crude oil production continued to exceed demand, resulting in rising inventories and downward pressure on near-term prices for both WTI and Brent. Since then, changes in regional market dynamics, including planned and unplanned refinery maintenance in the United States and increased refinery utilization in Europe, have caused changes in the structure of futures price curves for WTI and Brent and in the spread between the spot prices of the two benchmark crudes. U.S. commercial crude inventories are at a near record level in absolute terms (Figure 2).

After running at a record high average of 16.1 million barrels per day (bbl/d) in 2014, U.S. refineries recently reduced crude throughputs because of both planned and unplanned maintenance. EIA estimates that scheduled refinery maintenance for the first half of 2015 peaks in February and March, resulting in weaker demand for WTI-priced crudes and leading to a widening Brent-WTI spread. At the start of 2015, the four-week average of refinery gross inputs was 16.7 million bbl/d. As of February 27, the four-week average for gross inputs had fallen by 1.0 million bbl/d. In its March Short-Term Energy Outlook, EIA expects U.S. refinery runs will increase in the coming months, peaking at 16.4 million bbl/d in the third quarter 2015. Increased crude demand by U.S. refineries will put upward pressure on WTI prices, which could lead to a narrowing of the Brent-WTI spread.

At the same time, trade press has reported that European refineries are operating at the highest levels in 18 months as a result of lower absolute Brent prices, and to increase product inventories in anticipation of refinery maintenance in Europe that is expected to begin in March. Extreme cold temperatures in the Northeast United States have also boosted demand for heating oil imports. So far this year, the four-week average distillate imports into the East Coast have been above the historical five-year average.

With reduced U.S. refinery runs and continuing strong domestic crude oil production, U.S. commercial crude oil inventories in January were at a record level, providing the most days of supply since January 1992. Commercial crude inventories at the end of January were sufficient to supply almost 27 days of U.S. refinery demand based on February refinery runs (Figure 3). U.S. inventories continued to grow in February, to 29 days of supply based on estimated March refinery crude runs, the highest since May 1985. High crude oil inventories in the United States are putting downward pressure on prompt prices for U.S. crude oil relative to prices for delivery further in the future.

OECD commercial crude oil inventories are also high, but less so compared with U.S. inventories. OECD crude oil inventories in January were sufficient to supply almost 28 days of OECD crude oil demand, however, unlike in the United States, OECD inventories exceeded 28 days in multiple months over the previous two years.

The higher U.S. crude oil inventories on a days-supply basis in January and February, compared with the more typical OECD days supply, help to explain why the increase of U.S. crude oil prices in February was smaller compared to Brent, widening the differential between domestic and international crude oil prices. The Brent-WTI spread settled at $9.74 per barrel on March 6, an increase from the start of the year and near the highest spread between these two benchmarks since January 2014.

Despite the recent increase in U.S. crude inventories, days of supply are still significantly below the peaks reached in the early 1980s. Furthermore, there is still an estimated 200 million barrels of storage capacity available in the United States. However, it should be noted that operation of crude oil storage and transportation systems requires some amount of working storage to be available to be filled at all times in order to receive deliveries by pipeline, tanker, barge, and rail. In EIA's latest forecast, U.S. crude inventories peak in May and then start to decline as U.S. refinery runs increase by 0.8 million bbl/d and U.S. crude production growth flattens and then declines slightly in the third quarter.

U.S. average gasoline and diesel prices up a penny

The U.S. average retail price for regular gasoline rose by one cent over last week to $2.49 per gallon as of March 9, but the price remains $1.03 cents per gallon below last year. Prices increased in all regions except the Midwest, where prices fell 4 cents to average $2.34 per gallon. Prices increased by 11 cents per gallon in the Rocky Mountain region to average $2.23 per gallon. The Gulf Coast price was up a penny to also average $2.23 gallon. The East Coast increased by 4 cents to $2.42 per gallon. Prices in the West Coast, which had a significant price increase last week as a result of regional refinery disruptions, increased by 5 cents to average $3.18 per gallon.

The U.S. average retail price for diesel fuel increased a cent over last week to average $2.94 per gallon as of March 9, but the price remains $1.08 per gallon below last year. Prices fell on the West Coast and Gulf Coast by a fraction of a cent to average $3.10 per gallon and $2.80 per gallon respectively. The East Coast and Rocky Mountain price each increased by 2 cents to average $3.11 and $2.80 per gallon, respectively. In the Midwest, prices rose a fraction of a cent to average $2.85 per gallon.

Propane inventories fall

U.S. propane stocks decreased by 1.3 million barrels last week to 53.7 million barrels as of March 6, 2015, 27.7 million barrels (106.2%) higher than a year ago. Midwest, East Coast, and Rocky Mountain inventories decreased by 2.5 million barrels, 0.3 million barrels, and 0.1 million barrels, respectively, while Gulf Coast inventories increased by 1.5 million barrels. Propylene non-fuel-use inventories represented 8.4% of total propane inventories.

Residential heating fuel prices decrease

As of March 9, 2015, residential heating oil prices averaged nearly $3.21 per gallon, 8 cents per gallon lower than last week, and almost 99 cents per gallon less than last year's price for the same week. Wholesale heating oil prices averaged $2.14 per gallon, 23 cents per gallon lower than last week and $1.17 per gallon lower when compared to the same time last year.

Residential propane prices averaged just below $2.36 per gallon, 1 cent per gallon lower than last week, and nearly 81 cents per gallon less than the price at the same time last year. The average wholesale propane price decreased by 2 cents per gallon this week to 76 cents per gallon, nearly 67 cents per gallon lower than the March 10, 2014 price.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at 202-586-0786.

Retail prices (dollars per gallon)

| Retail prices | Change from last | ||

|---|---|---|---|

| 03/09/15 | Week | Year | |

| Gasoline | 2.487 | 0.014 | -1.025 |

| Diesel | 2.944 | 0.008 | -1.077 |

| Heating Oil | 3.208 | -0.080 | -0.987 |

| Propane | 2.359 | -0.011 | -0.806 |

Futures prices (dollars per gallon*)

| Futures prices | Change from last | ||

|---|---|---|---|

| 03/06/15 | Week | Year | |

| Crude oil | 49.61 | -0.15 | -52.97 |

| Gasoline | 1.882 | 0.114 | -1.092 |

| Heating oil | 1.869 | -0.430 | -1.143 |

| *Note: Crude oil price in dollars per barrel. | |||

Stocks (million barrels)

| Stocks | Change from last | ||

|---|---|---|---|

| 03/06/15 | Week | Year | |

| Crude oil | 448.9 | 4.5 | 78.9 |

| Gasoline | 239.9 | -0.2 | 16.1 |

| Distillate | 125.5 | 2.5 | 11.6 |

| Propane | 53.744 | -1.326 | 27.685 |