Reasons for projected natural gas-fired generation growth vary by region

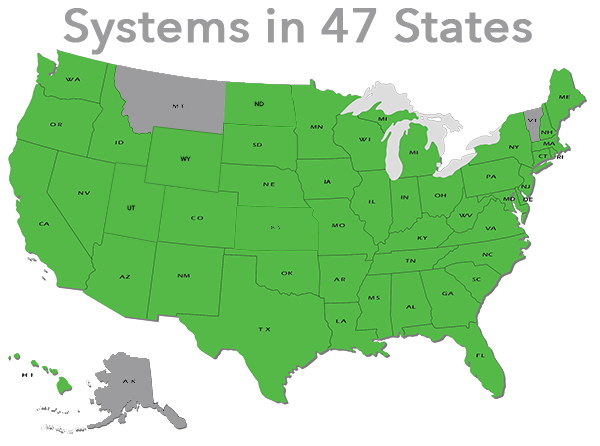

EIA projects that natural gas-fired electric power sector generation in the contiguous United States will increase to 1,600 million megawatthours (MWh) by 2040, a 1.3% average annual increase. This growth is spread throughout the Lower 48 states, and the reasons for the growth vary by region.

For the United States, increasing natural gas supply results in unexpected future growth in natural gas-fired electric generation, particularly after 2020. Total U.S. natural gas production increases 56% from 2012 to 2040, largely because of the development of shale gas, tight gas, and offshore natural gas resources.

The three regions with the highest growth in natural gas-fired generation, SERC, RFC, and WECC, also have the highest overall amounts of coal-fired generation. Coal-fired generation still grows significantly in SERC Reliability Corporation (SERC) and ReliabilityFirst Corporation (RFC), despite significant retirements of coal-fired capacity, and the increased cost of building new coal-fired facilities. In the Western Electricity Coordinating Council (WECC), natural gas-fired power competes with renewable sources for future electric power demand, while in the Texas Reliability Entity (TRE) region, natural gas accounts for almost all the growth in new generation.

Source: U.S. Energy Information Administration, Annual Energy Outlook 2014 Reference case

Note: Totals exclude electric generation in the end-use sector.

The SERC and RFC regions cover many of the states in the Southeast, Mid-Atlantic, and Midwest. The RFC contains the Appalachian Basin's Marcellus Shale play, the country's largest and fastest-growing natural gas production basin. Both SERC and RFC contain portions of the Central Appalachian (CAPP) coal production basin, and RFC contains the Illinois Basin, where coal production has expanded rapidly.

In both regions, natural gas-fired generation competes with coal-fired generation for existing power demand in the near term, but in the medium- to long-term, natural gas generation is driven by growth in overall power demand. Natural gas-fired generation in the RFC benefits from more retired coal capacity, but overall coal-fired generation still grows in the region, which has relatively more access than SERC to inexpensive coal from the Illinois Basin and western United States. Gas-fired generation in SERC benefits more from higher growth in overall electric power consumption (1.0% annual average growth in SERC, versus 0.6% in RFC). Only WECC and Florida experience more rapid growth in overall electric power consumption than SERC through 2040, but natural gas accounts for the largest share of this growth in SERC, versus renewables in WECC, and nuclear power in Florida.

2012-40. Natural gas-fired generation in the power sector in SERC rises by 109 million MWh, the largest increase in the United States, while in RFC, it rises by 103 million MWh, the third-largest increase in the United States. Coal-fired power remains the largest generation source in both regions through 2040. Near-term growth. In both SERC and RFC, natural gas-fired generation falls through 2014 in response to higher gas prices, and then regains its market share in 2015 and 2016, in response to coal-fired plant capacity retirements. Cumulative coal plant retirements through 2016 are greater in RFC (20 gigawatts) than in SERC (12 gigawatts). Medium- to long-term growth. Increased natural gas prices cause natural gas-fired generation in SERC to decline through 2019, with coal-fired generation increasing, while gas-fired generation increases in RFC. Natural gas-fired generation rises in response to higher production in both of these regions after 2020, surpassing nuclear generation by 2035.

Source: U.S. Energy Information Administration, Annual Energy Outlook 2014 Reference case

Note: Totals exclude electric generation in the end-use sector.

The WECC region encompasses the Rocky Mountains, Pacific Northwest, and southwestern United States. A number of fast-growing natural gas basins are in or near this region: the Niobrara Basin, the Williston Basin's Bakken Shale, and the Permian Basin. The region also has access to coal production from the Powder River Basin in Wyoming and Montana. However, the region's main source of generation comes from renewables, which include both hydroelectric generation in California and the Pacific Northwest, as well as significant amounts of renewable generation from nonhydro sources. Natural gas-fired generation in WECC grows alongside renewable generation, as requirements in renewable portfolio standards also necessitate additional generation to complement renewables for load-balancing purposes, particularly in California, for which natural gas is the most commonly used fuel.

2012-40. Natural gas-fired generation WECC rises by 105 million MWh, the second-largest increase in the United States. Renewable power generation, including hydroelectric generation, remains WECC's largest generation source through 2040. Natural gas-fired and renewable generation in the electric power sector both rise by an annual average of 1.5%, while coal-fired generation decreases. Near-term. Higher natural gas prices lead to lower gas-fired generation in WECC through 2016. Demand for natural gas-fired power is largely unaffected by coal plant retirements, which are rare in this region. Medium- to long-term. Natural gas-fired generation rises significantly beginning in 2018, and replaces coal as the region's second-largest power source in 2021.

Source: U.S. Energy Information Administration, Annual Energy Outlook 2014 Reference case

Note: Totals exclude electric generation in the end-use sector.

The TRE region covers most of Texas. It includes much of the Permian Basin as well as the Eagle Ford Shale in South Texas, a rapidly growing source of shale gas production. It also contains part of the Haynesville Shale in Texas and Louisiana, where production has slowed in recent years, but is expected to grow in the medium term. Texas has access to locally mined low-grade lignite coal, as well as larger volumes of Powder River Basin and Uinta Basin coal. Coal from these basins is significantly less expensive than coal from other U.S. supply sources and has lower transport costs.

Like in SERC and RFC, natural gas-fired generation competes with generation from coal in the near term in the TRE region, but differs from all other regions in that it becomes TRE's sole source of electric generation growth from 2016 to 2040.

2012-40. Natural gas-fired generation remains the largest source of power generation in the TRE region through 2040. Gas-fired generation rises by 81 million MWh, the fourth-largest increase in the United States. Coal-fired, renewable, and nuclear generation are all virtually flat through 2040, with increased gas-fired generation satisfying almost all of the region's 0.9% per year electric power demand growth. Near-term. Natural gas-fired generation falls through 2015, as higher natural gas prices make coal a relatively more economical source of power generation. Like WECC, very little coal-fired capacity is expected to be retired in the near term in TRE. Medium- to long-term. Natural gas-fired generation rises starting in 2016, as the region's increased production, coupled with the relatively high cost of building coal-fired power plants, make natural gas the primary fuel used to satisfy the region's electric power demand growth.