Gasoline specification changes and price effects (3/25/2015)

Release date: March 25, 2015 | Next release date: April 1, 2015

While the vernal equinox on March 20th marks the first official day of spring, the transition from winter-grade gasoline to spring-grade gasoline, an intermediate step in the shift to summer-grade gasoline, began much earlier. The transition occurs along the gasoline supply chain, from refineries to retail outlets, and affects spot, wholesale and retail gasoline prices because the cost to manufacture spring and summer-grade gasoline is higher than the cost to manufacture gasoline used in the winter.

Federal and state environmental regulations specify the properties of finished gasoline that can be sold at retail stations across the United States. Many specifications, like octane rating, remain constant from season to season. However, Reid Vapor Pressure (RVP), a measure of how easily petroleum liquids evaporate, changes to accommodate seasonal temperature variations that affect both the performance of gasoline in an internal combustion engine and emissions. In the winter, higher RVP ensures that gasoline combusts easily at very low temperatures; in the spring and summer, a lower-RVP gasoline prevents vapor lock, when too much vapor may prevent an engine from starting, and reduces evaporative emissions into the atmosphere that contribute to smog. For more information on Federal gasoline regulations and specifications see the Environmental Protection Agency.

The diverse specifications for finished gasoline create the need for different types of Blendstock for Oxygenate Blending (BOB), the petroleum component of gasoline that is produced by refineries and blended with ethanol to produce the finished gasoline that is sold at retail stations. BOBs include RBOB, which is used to make the reformulated gasoline that is required in regions with high smog levels, and is optional elsewhere. CBOB, the most common, is the basis for the conventional gasoline that is sold in regions that do not require reformulated gasoline. CARBOB is used to make gasoline that meets the specifications defined by the California Air Resources Board; and AZBOB is used to make gasoline that meets the specifications required by the state of Arizona.

The more stringent specifications for reformulated gasoline, as well as for gasoline sold in California and Arizona, increase the manufacturing cost compared with conventional gasoline. The cost increment increases as the RVP specification decreases, and during the spring and summer, the extra cost to produce RBOB causes its spot price to move higher than the spot price of CBOB (Figure 1).

The timing of the shifts from winter-grade to spring-grade gasoline and from spring to summer-grade gasoline vary by region. The transition happens earlier in areas of the country where temperatures warm earlier in the calendar year, like southern California. In addition, because of the length of the gasoline supply chain, refineries begin manufacturing spring and summer-grade gasoline well before the date by which regulations require it be available at retail stations.

U.S. Gulf Coast (USGC) refineries, which supply a substantial amount of gasoline to the U.S. Northeast, begin manufacturing the lower-RVP spring-grade gasoline needed in the Northeast well before the date by which that gasoline must be available at retail stations.

The lower-RVP gasoline blendstock must move through the distribution system (pipelines and terminals) to the retail station before the lower-RVP retail requirement deadline arrives. As a result, the spot prices for CBOB and RBOB in USGC reflect the more-costly spring gasoline sooner than RBOB and CBOB prices in New York Harbor.

Since petroleum product pipeline systems closely monitor and control the quality and composition of the products being shipped, pipelines play an important role in the RVP transition. Petroleum product pipelines have shipping calendars divided into cycles, and the pipelines determine the maximum RVP allowed into their system during a given cycle depending on individual system needs. Pipeline RVP transitions run ahead of deadlines for transitions at the retail level, allowing the supply chain to adjust.

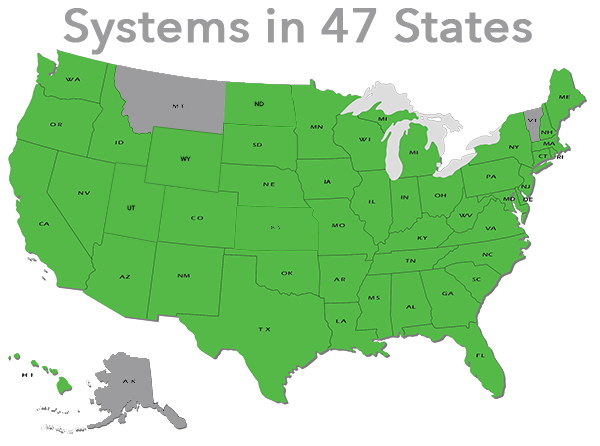

Spot gasoline prices for a particular region are strongly linked to the predominant delivery system into the region. Thus, spot prices in most major markets will move in accordance with the pipeline RVP changes. Figure 2 illustrates the major pipelines and gasoline spot markets in the United States.

Spot prices for gasoline blendstocks are often volatile during the winter-to-spring-to-summer transition. Market participants may lower prices for higher-RVP blendstock that remains in inventory in order to move it out of inventory before the RVP changeover. The opposite may also happen when supplies of higher-RVP blendstock run short before the changeover date. Once the RVP change has occurred, spot prices typically return to an equilibrium level, absent other changes in the market. Periods of market volatility can occur several times over the course of a transition period as pipeline RVP specifications step down from winter through to summer.

The RVP transition's impact on price is easily and readily apparent in California gasoline markets, due to the state's unique gasoline specification and distribution system. In California, pipelines require the RVP of gasoline to transition from the December-January specification of 15 pounds per square inch (psi), to 13.5 psi in February and March, and down to 5.99 psi from April to October. During the transition months, spot prices for gasoline in California (Los Angeles and San Francisco) before the specification change typically are lower than prices after the RVP change (Figure 3).

As noted in EIA analysis, changes in crude prices and spot gasoline prices will be mostly passed through to retail gasoline prices over the course of two weeks. However, the increased cost for lower-RVP gasoline occurs over a longer period, the timing of which varies by geography and is different than the price pass-through examined in previous EIA analysis. So, while springtime for U.S. gasoline markets arrived ahead of the March 20 vernal equinox, the full impact on retail prices will take time to appear.

U.S. average gasoline prices up slightly, diesel fuel prices decrease

The U.S. average price for regular gasoline increased less than a penny from last week to $2.46 per gallon as of March 23, 2015, $1.09 per gallon lower than at the same time last year. The Midwest price, which increased 11 cents to $2.39 per gallon, was mostly responsible for the increase in the U.S. average. The Rocky Mountain price posted the only other increase, up two cents to $2.30 per gallon. The West Coast price fell seven cents to $3.05 per gallon. The East Coast price was down four cents to $2.36 per gallon, and the Gulf Coast price decreased three cents to $2.19 per gallon.

The U.S. average price for diesel fuel decreased five cents from the week prior to $2.86 per gallon, down $1.12 per gallon from the same time last year. The West Coast and East Coast prices each fell six cents, to $3.00 per gallon and $3.03 per gallon, respectively. The Midwest, Gulf Coast, and Rocky Mountain prices each were down five cents, to $2.77 per gallon, $2.72 per gallon, and $2.77 per gallon, respectively.

Propane inventories Gain

U.S. propane stocks increased by 0.7 million barrels last week to 55.0 million barrels as of March 20, 2015, 29.3 million barrels (114.4%) higher than a year ago. Midwest inventories increased by 0.4 million barrels and East Coast inventories increased by 0.2 million barrels. Gulf Coast inventories increased by 0.1 million barrels while Rocky Mountain/West Coast inventories were unchanged. Propylene non-fuel-use inventories represented 8.5% of total propane inventories.

Residential heating fuel prices decrease

As of March 23, 2015, residential heating oil prices averaged nearly $2.93 per gallon, almost 11 cents per gallon lower than last week. Wholesale heating oil prices averaged $1.90 per gallon, 3 cents per gallon lower than last week.

Residential propane prices averaged $2.32 per gallon, 2 cents per gallon lower than last week. The average wholesale propane price decreased by nearly 6 cents per gallon this week to 63 cents per gallon.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at 202-586-0786.

Retail prices (dollars per gallon)

| Retail prices | Change from last | ||

|---|---|---|---|

| 03/23/15 | Week | Year | |

| Gasoline | 2.457 | 0.004 | -1.092 |

| Diesel | 2.864 | -0.053 | -1.124 |

| Heating Oil | 2.928 | -0.105 | NA |

| Propane | 2.322 | -0.020 | NA |

Futures prices (dollars per gallon*)

| Futures prices | Change from last | ||

|---|---|---|---|

| 03/20/15 | Week | Year | |

| Crude oil | 45.72 | 0.88 | -53.74 |

| Gasoline | 1.798 | 0.036 | -1.110 |

| Heating oil | 1.734 | 0.021 | -1.186 |

| *Note: Crude oil price in dollars per barrel. | |||

Stocks (million barrels)

| Stocks | Change from last | ||

|---|---|---|---|

| 03/20/15 | Week | Year | |

| Crude oil | 466.7 | 8.2 | 84.2 |

| Gasoline | 233.4 | -2.0 | 16.2 |

| Distillate | 125.8 | 0.0 | 13.4 |

| Propane | 55.003 | 0.719 | 29.345 |