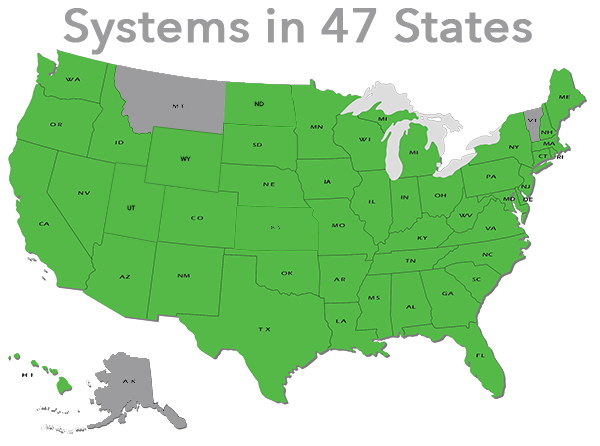

Energy resource permanent funds vary by purpose and state

Source: State Treasurer's Office reports for each state as of December 31, 2014

Note: * West Virginia's fund is too new to show a measurable balance.

Taxation of coal, crude oil, and natural gas production presents opportunities for states to collect revenue as nonrenewable resources are produced. Natural resource permanent funds are revenues earned from taxing the extraction of energy resources and are set aside by national, state, and local governments for strategic or long-term use. Similar to an endowment, states typically only spend the earnings and investment gains from these funds, as expenditure of principal is usually prohibited unless authorized by legislative approval or constitutional amendments.

Eight states have permanent funds primarily funded by oil, coal, or natural gas tax revenues. Many of these funds also include funding from royalties and leases on public lands granted to a state by the federal government at the time of statehood, such as permanent school or permanent university funds. For example, the Texas Permanent School Fund was established in 1854 to provide funding for public education. Today the $37.2 billion fund is predominantly dependent on revenue received from oil and natural gas development on state lands.

The Alaska Permanent Fund, created in 1976, has a $52 billion fund balance that exceeds the balance of national funds of major oil and natural gas producers such as Venezuela, Mexico, and Angola.

As in Alaska, constitutional amendments in the 1970s created permanent funds in New Mexico and Wyoming. In Wyoming, the country's largest coal producer, the Permanent Mineral Trust Fund consists of all severance tax revenue derived from coal, oil, natural gas, and other minerals. The fund's income is annually distributed to support the state general fund. New Mexico's Severance Tax Permanent Fund sets aside a portion of severance tax revenue to support the general fund, as well as public education and infrastructure development.

In between the energy price spikes of the 1970s and 2000s, two Gulf Coast states (Alabama and Louisiana) created permanent funds in response to oil and gas offshore production opportunities. The discovery of significant natural gas reserves in 1978 prompted the creation of the Alabama Trust Fund. Initially capitalized by a legal settlement over oil and gas royalties, the Louisiana Education Quality Trust Fund was created in 1986 to support primary, secondary, and higher education programs across the state.

Permanent funds have recently been created in several states in response to the rapid growth of tight oil and shale gas production. In 2010, North Dakota voters authorized the North Dakota Legacy Fund to reserve 30% of total revenue collected from taxes on oil and gas production, including tight oil produced in the Bakken Region. In March 2014, the West Virginia Future Fund was created to reserve a portion of shale gas revenue from activity in the Marcellus Region, as well as from other production in the state, for strategic purposes.

Among the eight states, the majority of permanent funds supplement general government expenditures. Alaska's permanent fund is unique in its annual distributions of income earnings to state residents.

Principal contributor: Grant Nülle