EIA's Drilling Productivity Report predicts May tight oil production below April's level (4/22/2015)

Release date: April 22, 2015 | Next release date: April 29, 2015

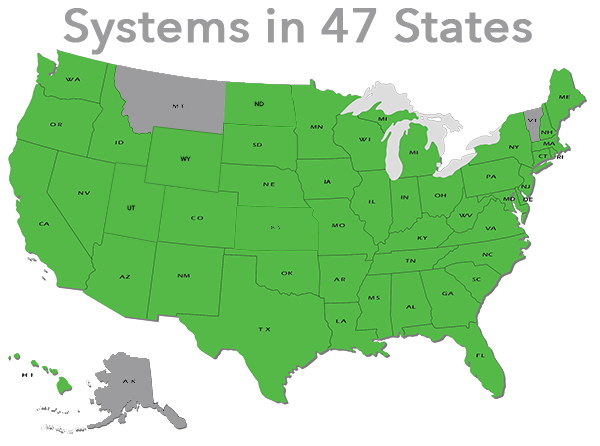

In the April Drilling Productivity Report (DPR), EIA estimates that total crude oil production from the seven U.S. regions analyzed, which together accounted for about 95% of domestic crude oil production growth during 2011-13, will fall by 57,000 barrels per day (bbl/d) in May. This is the first time the DPR has indicated a decline in expected production levels since the report was first issued in October 2013.

When crude oil prices began to fall sharply in mid-2014 as the global balance between oil supply and demand loosened, there was much discussion about how the market might respond. U.S. tight oil production, in part because of shorter development lead times and steep decline rates, was widely viewed as more likely than other production streams to be curtailed in response to lower crude prices. However, the timing and location of such reductions was uncertain. The latest DPR estimates shed light on how this trend may evolve.

The April DPR's lower production forecast is attributable to declines in the Bakken, Eagle Ford, and Niobrara regions, while Permian production continues to increase slightly (Figure 1). Crude production in the other three DPR regions—Haynesville, Marcellus, and Utica—remains low and flat as drilling activity in those regions is largely directed toward natural gas extraction.

In response to months of falling crude prices, rig counts decreased recently in all four DPR regions that primarily produce oil (Figure 2). The Bakken rig count was first to decline, in October 2014, followed by Eagle Ford and Niobrara in November. The Permian rig count moved lower in December, and since then all four regions have shown significant rig count declines through March 2015.

However, the reduction in rig counts did not immediately result in lower crude oil production. As has happened in the past when rig counts declined, the average productivity of a well drilled in each region increased, leading to continued, albeit slower, production growth.

Much of the crude produced in these four regions comes from horizontal drilling in tight oil plays. Steep decline rates for the wells means that growth in production can be sustained only if operators continue to drill new wells at a sufficient rate to offset production declines from existing (legacy) wells. In the April DPR, EIA estimates that in the Bakken, Eagle Ford, and Niobrara regions, output from newly drilled wells, despite their increased average productivity, will not exceed declines from legacy wells, leading to reductions in overall production.

Production in the Permian has not yet been reduced, despite the recent reduction in rig count. Until recently, most wells in this area were drilled vertically and as a result were less productive. For tight oil plays, a horizontally drilled well is typically more productive than a vertically drilled well. As the share of horizontal wells has increased in the Permian, average well productivity has increased, helping maintain overall production (Figure 3). Additionally, declines in production from legacy wells in the Permian have leveled off slightly, instead of accelerating as in the Bakken, Eagle Ford, and Niobrara regions. This provides additional support to continued crude production growth in the Permian.

In the April Short-Term Energy Outlook, EIA estimates that Lower 48 crude production (excluding the Gulf of Mexico) will average 7.33 million bbl/d in second quarter 2015 and then decline until second-quarter 2016.

Average U.S. retail gasoline and diesel fuel prices increase

The U.S. average price for regular gasoline increased eight cents from the previous week to $2.49 per gallon as of April 20, 2015, $1.20 per gallon less than at the same time last year. The Midwest price rose nine cents to $2.40 per gallon, as did the East Coast price, which increased to $2.44 per gallon. The Rocky Mountain price increased eight cents to $2.43 per gallon. The Gulf Coast and West Coast prices both increased five cents, to $2.24 per gallon and $2.97 per gallon, respectively.

The U.S. average diesel fuel price rose three cents from the week prior to $2.78 per gallon, $1.19 per gallon less than at the same time a year ago. The West Coast price rose five cents to $2.97 per gallon. The Gulf Coast price increased four cents and the Midwest price rose three cents, both reaching $2.66 per gallon. The Rocky Mountain and East Coast prices each rose one cent, to $2.71 per gallon and $2.93 per gallon, respectively.

Propane inventories gain

U.S. propane stocks increased by 2.0 million barrels last week to 62.0 million barrels as of April 17, 2015, 32.5 million barrels (110.1%) higher than a year ago. Gulf Coast inventories increased by 1.2 million barrels and Midwest inventories increased by 0.6 million barrels. Rocky Mountain/West Coast and East Coast inventories both increased by 0.1 million barrels. Propylene non-fuel-use inventories represented 7.4% of total propane inventories.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at 202-586-0786.

Retail prices (dollars per gallon)

| Retail prices | Change from last | ||

|---|---|---|---|

| 04/20/15 | Week | Year | |

| Gasoline | 2.485 | 0.077 | -1.198 |

| Diesel | 2.780 | 0.026 | -1.191 |

Futures prices (dollars per gallon*)

| Futures prices | Change from last | ||

|---|---|---|---|

| 04/17/15 | Week | Year | |

| Crude oil | 55.74 | 4.10 | NA |

| Gasoline | 1.930 | 0.123 | NA |

| Heating oil | 1.882 | 0.116 | NA |

| *Note: Crude oil price in dollars per barrel. | |||

Stocks (million barrels)

| Stocks | Change from last | ||

|---|---|---|---|

| 04/17/15 | Week | Year | |

| Crude oil | 489.0 | 5.3 | 91.3 |

| Gasoline | 225.7 | -2.1 | 15.7 |

| Distillate | 129.3 | 0.4 | 16.8 |

| Propane | 62.044 | 2.027 | 32.517 |