Cold winter weather increases Northeast distillate demand, but conditions are moderating (3/18/2015)

Release date: March 18, 2015 | Next release date: March 25, 2015

The Northeast is experiencing a colder-than-normal winter. Population-weighted temperatures from October through February were 11% colder than the National Oceanic and Atmospheric Administration (NOAA) projected at the start of the heating season, 10% colder than the 10-year average, and 1% colder than last winter. The cold weather increased demand for both distillate fuel and natural gas for residential and commercial space heating. As natural gas demand for space heating increased, the natural gas supply infrastructure reached its limits and could not provide enough natural gas to meet overall demand, which also includes commercial, industrial and power generation uses. One result was the curtailment of natural gas supplies to interruptible customers, who are mostly industrial users and electric generators, who responded to curtailments by increasing their own use of distillate fuel. Some customers also switched voluntarily from natural gas to distillate as natural gas prices spiked above distillate fuel prices.

The cold and substantial snowfall also disrupted the petroleum supply chain. The formation of ice in harbors and rivers complicated delivery of petroleum products to distribution terminals throughout the region. Meanwhile, some Northeast refineries also curtailed crude runs and reduced production of gasoline and distillate as cold interfered with operations.

The increased demand for distillate combined with the supply-chain disruptions caused the New York Harbor (NYH) spot price of ultra-low-sulfur diesel fuel (ULSD) to increase by $0.35 per gallon (gal) between January 23 and February 23, on top of a $0.31/gal increase attributable to the rise in the price of crude oil over the same period. As of February 23, the price of ULSD was $2.31/gal. As temperatures moderated and operations normalized along the petroleum supply chain, prices have since fallen. As of March 17, the price of ULSD in NYH was $1.71/gal (Figure 1).

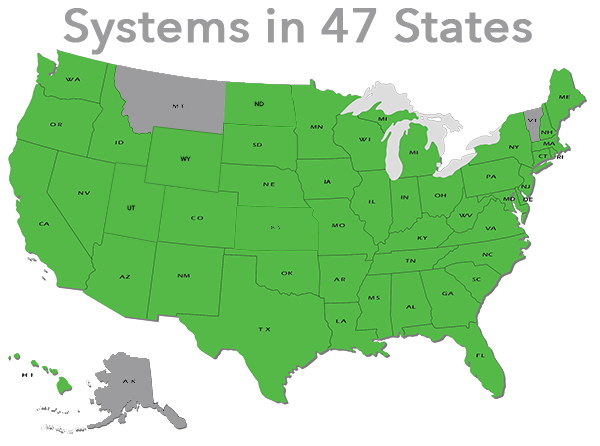

More than 80% of the homes in the United States that rely primarily on heating oil for space heating are in the Northeast. As a result, cold weather has a greater impact on distillate demand in the Northeast than in other regions of the country. However, over the past several years, that impact has become less pronounced as consumers have turned to other sources of energy for space heating. Since 2010 the number of Northeast households that use heating oil as the primary space heating fuel has declined by 16%, reducing the cold weather distillate demand response in the Northeast (Figure 2).

Distillate demand for power generation also increased significantly in the Northeast this winter. The region is one of the few areas of the country that continues to rely on petroleum-based products for power generation, albeit typically for short periods of time when the electric generation system is severely stressed. About 30% of the electric generating capacity in New York and New England can switch between natural gas and oil products and an additional 9% of capacity in the region is strictly oil-fired.

As the cold weather increased demand for natural gas for space heating, the natural gas supply infrastructure reached its limits and could not provide enough natural gas to meet overall demand, which also includes commercial, industrial, and power generation uses. When natural gas supplies are insufficient to meet demand, supply to so-called ‘interruptible’ customers can be curtailed, increasing natural gas available to residential customers and increasing distillate demand from those customers interrupted, which are mostly industrial customers and electric power generators. In addition, as natural gas demand increased, prices for natural gas spiked higher than distillate fuel (Figure 3), spurring voluntary fuel switching that further increased consumption of distillate for power generation by fuel-switchable and petroleum-only power generating units, which generally make decisions about the dispatch of electric generation units based on variable operating costs.

This winter’s cold weather also disrupted distillate supply and distribution networks in the Northeast. Boston and New York Harbors, along with other major waterways such as the Hudson and Delaware rivers, froze, complicating marine deliveries of petroleum products to distribution terminals. New England has no local refineries and most supplies enter the region through the ports of Boston, Massachusetts; Portland, Maine; and Providence, Rhode Island. In addition, New York Harbor also receives significant volumes of petroleum products via marine deliveries.

The logistical challenges in resupplying distillate to storage terminals combined with increased distillate demand for heating and power generation caused distillate inventories in the Northeast to decline by 8 million barrels (31%) between January 23 and February 27. As of February 27, distillate inventories in the Northeast (PADD 1A and PADD 1B) had fallen to 18 million barrels, the bottom of the five-year range (Figure 4). However, the Northeast is part of the actively traded Atlantic Basin petroleum market and, as is typically the case in the winter, imports increased to meet demand and barrels from Canada, Europe, and Russia resupplied the region.

The most recent inventory data as of March 18 show distillate stocks have stabilized. Natural gas customers with interruptible service are no longer being curtailed by constrained pipelines, reducing their demand for distillate fuel, and natural gas prices have fallen back below distillate prices, eliminating the market incentive for switching to distillate. Recent weather forecasts also suggest the harsh winter weather is ending. As temperatures continue to moderate, the distillate supply situation in the Northeast should continue to improve.

U.S. average gasoline and diesel prices decrease

The U.S. average retail price for regular gasoline decreased three cents from last week, to $2.45 per gallon as of March 16, 2015, $1.09 per gallon lower than the same time last year. The only increase in price occurred in the Rocky Mountain region, up six cents to $2.29 per gallon. The West Coast price was down seven cents, to $3.12 per gallon. The Midwest price decreased five cents to $2.29 per gallon. The East Coast price fell two cents to $2.40 per gallon, and the Gulf Coast price was down a penny to $2.22 per gallon.

The U.S. average price for diesel fuel decreased three cents from the week prior to $2.92 per gallon, down $1.09 per gallon from the same time last year. The Midwest, Gulf Coast, and West Coast prices each fell three cents to $2.82 per gallon, $2.76 per gallon, and $3.06 per gallon, respectively. The East Coast price decreased two cents to $3.08 per gallon. The Rocky Mountain price increased one cent, to $2.81 per gallon.

Propane inventories Gain

U.S. propane stocks increased by 0.5 million barrels last week to 54.3 million barrels as of March 13, 2015, 28.0 million barrels (106.9%) higher than a year ago. Gulf Coast inventories increased by 1.3 million barrels and East Coast inventories increased by 0.1 million barrels. Midwest inventories decreased by 0.8 million barrels, while Rocky Mountain/West Coast inventories were unchanged. Propylene non-fuel-use inventories represented 8.5% of total propane inventories.

Residential heating fuel prices decrease

As of March 16, 2015, residential heating oil prices averaged $3.03 per gallon, nearly 18 cents per gallon lower than last week, and $1.09 per gallon less than last year's price for the same week. Wholesale heating oil prices averaged $1.93 per gallon, almost 21 cents per gallon lower than last week and just under $1.26 per gallon lower when compared to the same time last year.

Residential propane prices averaged $2.34 per gallon, nearly 2 cents per gallon lower than last week, and almost 74 cents per gallon less than the price at the same time last year. The average wholesale propane price decreased by more than 7 cents per gallon this week to just under 69 cents per gallon, nearly 69 cents per gallon lower than the March 17, 2014 price.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at 202-586-0786.

Retail prices (dollars per gallon)

| Retail prices | Change from last | ||

|---|---|---|---|

| 03/16/15 | Week | Year | |

| Gasoline | 2.453 | -0.034 | -1.094 |

| Diesel | 2.917 | -0.027 | -1.086 |

| Heating Oil | 3.030 | -0.177 | -1.093 |

| Propane | 2.342 | -0.017 | -0.737 |

Futures prices (dollars per gallon*)

| Futures prices | Change from last | ||

|---|---|---|---|

| 03/13/15 | Week | Year | |

| Crude oil | 44.84 | -4.77 | -54.05 |

| Gasoline | 1.762 | -0.120 | -1.198 |

| Heating oil | 1.713 | -0.156 | -1.230 |

| *Note: Crude oil price in dollars per barrel. | |||

Stocks (million barrels)

| Stocks | Change from last | ||

|---|---|---|---|

| 03/13/15 | Week | Year | |

| Crude oil | 458.5 | 9.6 | 82.7 |

| Gasoline | 235.4 | -4.5 | 13.1 |

| Distillate | 125.9 | 0.4 | 15.0 |

| Propane | 54.284 | 0.540 | 28.043 |